On 15 May 2024, Almaty

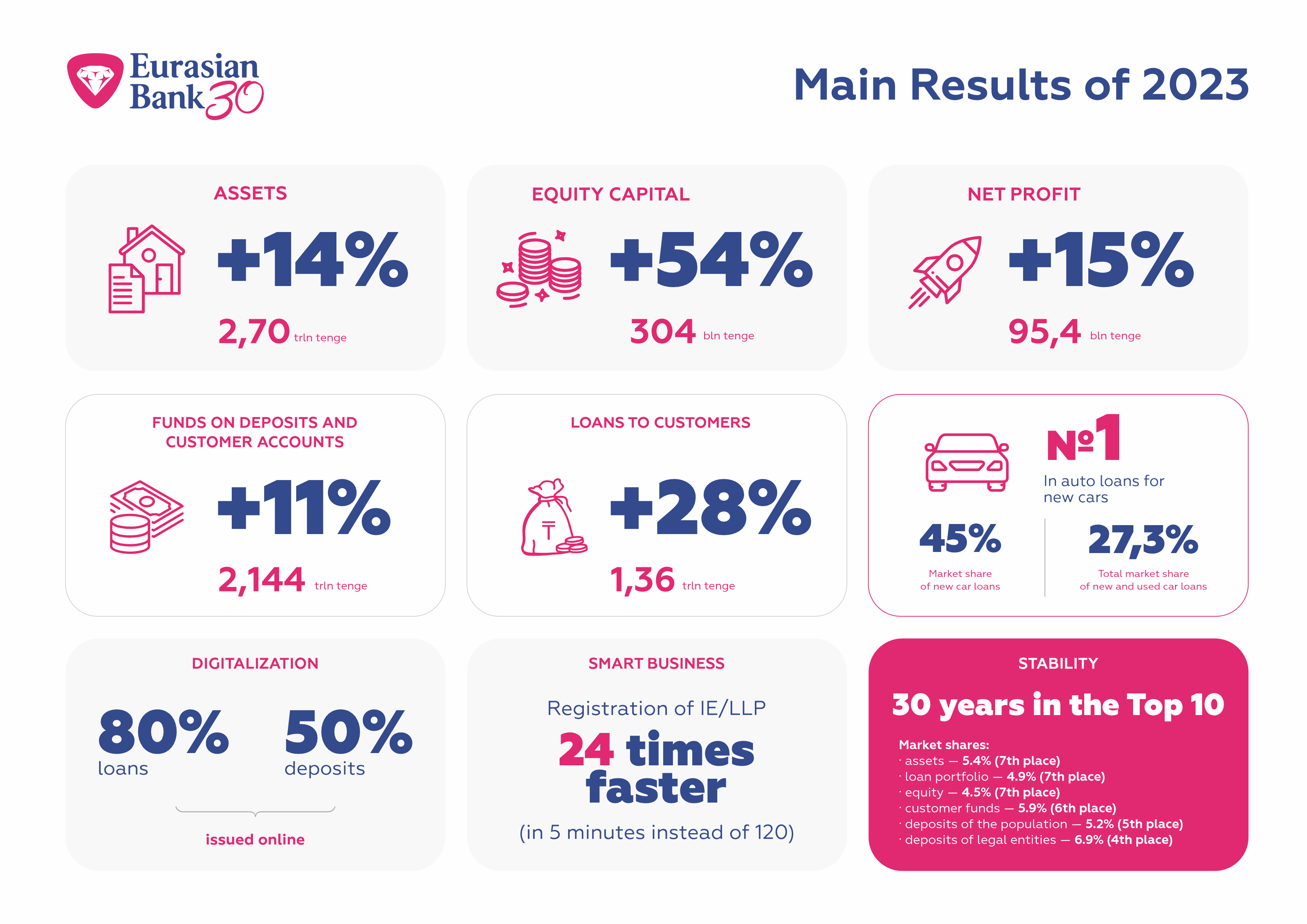

Eurasian Bank increased its capital by one and a half times, and the equity amount exceeded KZT 304 billion by the end of 2023. During this period, the Bank assets increased by 14% to KZT 2.70 trillion, and its profit increased to KZT 95.4 billion, or by 15% compared to the previous year 2022.

The Eurasian Bank Group financial results are published in the consolidated financial statements prepared in accordance with IFRS standards and confirmed by the international audit opinion.

Non-consolidated profit of the Bank for 2023 in the amount of KZT 96.8 bln by the shareholders’ decision was capitalised into retained earnings of previous years. It was resolved not to pay dividends on common shares of Eurasian Bank JSC.

«We achieved significant capital inflows, which allows us to expand the financing opportunities of our customers and the economy by increasing assets and investing in the development of new products. Over the past year, we focused on digitalization and improving the customer experience. Updating versions of mobile applications and connecting government services to Smartbank and Smart Business directly affected the increase in NPS. The impressive increase in the deposit portfolio, especially in retail, confirms the commitment of people and companies to the Bank as a stable financial institution. Thank you for your trust, with love, Eurasian! – under this slogan we continue to work today, in the year of the 30th anniversary of the Bank. We are focused on serving customers and business partners with a high level of reliability, trust and convenience», said Lyazzat Satiyeva, CEO of Eurasian Bank.

The Moody’s Investors Service international rating agency twice in 2023, which is quite rare for the industry, upgraded the long-term deposit ratings of Eurasian Bank to Ba3 from B2, as well as its basic credit rating to b1 from b3 with a positive outlook, noting the effective work of the Bank on reducing non-performing assets and the ability to generate profits.

The quality of the Bank loan portfolios is at a high level. The NPL +90 share decreased to 4.19% on 1 January 2024 from 6.69% a year earlier due to efficient risk management and work on overdue loans repayment.

Digital transformation and updating of the IT architecture allowed the Bank to transfer most of its services and products to the online format: almost 80% of all loan applications were accepted and more than 50% of deposit products are now available online.

Key indicators of the consolidated financial statements:

- The growth of the Eurasian Bank Group assets in 2023 by 14% to KZT 2.70 trillion from KZT 2.36 trillion in 2022, including due to the growth of the Bank’s loan portfolio.

- The expansion of lending in the 12 months of 2023 increased by 28% to KZT 1.36 trillion from KZT 1.06 trillion.

- Net interest income increased by 63% due to the expansion of lending to the economy, both in the corporate and retail segments.

- The increase in funds on deposits and customer accounts was 11% — up to KZT 2,144 trillion from KZT 1,931 trillion, which the Bank regards as a high degree of customer confidence.

- An increase in the Bank equity by 54% to KZT 304.1 billion due to the investment of retained earnings from previous years.

- The equity capital adequacy ratio is 21.7% at the norm of 10%, one of the best indicators on the market, allows for continued active growth.

- Consolidated net profit increased by 15%.

ADDITIONAL INFORMATION*

Market shares

In 2023, the Bank confidently maintained its position by key financial indicators:

- assets — with a 5.4% share (7th place)

- loan portfolio — with a 4.9% share (7th place)

- capital — with a 4.5% share (7th place)

- customer funds — with a 5.9% share (6th place)

- deposits of the population — with a 5.2% share (5th place)

- deposits of legal entities — with a 6.9% share (4th place)

RETAIL BUSINESS

- The Bank holds the leadership – No. 1 with a market share of 45% in auto loans for new cars and 27.3% of the market – cumulatively – in loans for the purchase of new and used cars with a significant increase in competition in this segment.

- The focus on digitalization, improvement of the customer path and expansion of the product line allowed us to increase:

– loan portfolio volume by 28%,

– customer funds by 22%

– net operating income by 30% for the year.

- The Bank entered the top 5 banks that exceeded KZT 1 trillion in individual deposits (5th place in absolute terms +KZT 202 billion per year.)

- Due to timely anti-fraud measures in the Smartbank mobile application, the number of fraud cases on card transactions and loans decreased by 5 times.

- The release of an updated version of the mobile application in August 2023 contributed to the growth of Smartbank NPS from 11% to 26%.

CORPORATE BUSINESS

- Loans issued to corporate customers increased by 14% or KZT 59 billion in 2023.

- As a result of updating the Smart Business remote banking system, a series of new products and services were launched, and the functionality of the mobile service was expanded, including in government services (GovTech).

- The Bank expanded its product line for business card products and continues to work on digitalization of other products for customers.

- Digital bid guarantees and a service for registering individual entrepreneurs, opening accounts for individual entrepreneurs/LLP through the Bank website were launched, which allowed entrepreneurs to open individual entrepreneur’s accounts online — 24 times faster (from 120 to 5 minutes).

In addition to the Eurasian Bank Group includes subsidiaries – Eurasian Project 1 LLP and Eurasian Project 2 LLP. Eurasian Financial Company JSC is the parent company of the bank and owns 100% of the Bank shares.

Eurasian Bank PR Service

+7 (727) 259-95-99

press@eubank.kz

*The information is based on the data from the NBRK and the Bank internal analytics